UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

CDW CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

| No fee required. |

| Fee paid previously with preliminary materials. |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |||

| |||

| “ |

Dear Fellow Stockholder,

The past two extraordinary years changedpace and proliferation of technology change is accelerating at an unprecedented rate. Technology is more complex, and more interconnected with levels of choice and complexity not seen before. And that is where our world,value proposition really shines. We help our business and our lives. In the blink of an eye, organizations of all types and sizes were forcedcustomers cut through complexity to dramatically and rapidly change how they operate. To change how and where they worked, learned, connected and servedmaximize their customers, communities and stakeholders. Throughout these two extraordinary years there was one constant – our unwavering dedication to meet rapidly evolving customer needs with speed, agility and skill to deliver the outcomes our more than 250,000 customers around the globe turned to us to provide, which fueled another year of record results and market outperformance for CDW.

While the past two years have been challenging, they also highlight the boundless opportunity that lies ahead for CDW. If the pandemic has shown us anything, it is thatreturn on technology is essential to all sectorsinvestments. With steadfast execution of our economy and will play an increasinglycustomer centric strategy, we are more important role in the years ahead. Our role as a trusted, strategic partnerthan ever to our customers is more important now than ever. Weas we help them harness the power of technology to make amazing happen.

As we move into 2024, IT market conditions remain complex. Geopolitical tensions continue to grow and macroeconomic conditions remain unsettled. While we do not know what the market will ultimately look like in 2024, there are two things we know for sure – technology will continue to be a critical driver of outcomes and CDW will be there for our customers’ partner of choice as we make technology work so people can do great things.customers wherever their priorities lie.

Annual Meeting Invitation

On behalf of our Board of Directors, I would like to invite you to CDW’s 20222024 Annual Meeting of Stockholders. The meeting will be held virtually on Thursday,Tuesday, May 19, 2022,21, 2024, at 7:30 a.m. CDT at www.virtualshareholdermeeting.com/CDW2022CDW2024. The attached Notice of Annual Meeting of Stockholders and Proxy Statement will serve as your guide to the business conducted at the meeting. Your vote is very important. Whether or not you plan to attend the Annual Meeting, we urge you to vote either via the Internet, by telephone, or by signing and returning a proxy card. Please vote as soon as possible so that your shares will be represented. For more information on CDW and to take advantage of our many stockholder resources and tools, we encourage you to visit our Investor Relations website at investor.cdw.com. Thank you for your continued trust in CDW and investment in our business.

Christine A. Leahy

Chair, President and Chief Executive Officer

April 7, 202210, 2024

| 1 |

When:

THURSDAY,TUESDAY, MAY 19, 202221, 2024

7:30 a.m. CDT

Where:

Live webcast online at

www.virtualshareholdermeeting.com/CDW2022CDW2024

REVIEW YOUR PROXY STATEMENT AND VOTE IN ADVANCE OF THE ANNUAL MEETING IN ONE OF FOUR WAYS: | ||

BY INTERNET USING Visit 24/7 www.proxyvote.com |  |  |

BY TELEPHONE Dial toll-free 24/7 |  |  |

BY MAILING Cast your ballot, sign your proxy |  |  |

BY INTERNET USING YOUR TABLET OR Scan this QR code 24/7 |  |  |

| Please refer to the enclosed proxy materials or the information forwarded by your broker, bank, or other holder of record to see which voting methods are available to you. | ||

of Annual Meeting of Stockholders |

WE ARE PLEASED TO INVITE YOU TO THE CDW CORPORATION ANNUAL MEETING OF STOCKHOLDERS. | |||

Items of business: | |||

| 1. | To elect the | ||

| 2. | To approve, on an advisory basis, named executive officer compensation; | ||

| 3. | To ratify the selection of Ernst & Young LLP as the | ||

| 4. | To consider and act upon the stockholder proposal, if properly presented at the Annual Meeting, regarding | ||

| 5. | To consider any other matters that may properly come before the meeting or any adjournments or postponements of the meeting. | ||

RECORD DATE

Holders of our common stock at the close of business on March 23, 202225, 2024 are entitled to notice of, and to vote at, the Annual Meeting.

HOW TO VOTE

Your vote is important to us. Please see "Voting Information"“Voting Information” on page 5 for instructions on how to vote your shares.

These proxy materials are first being distributed on or about April 7, 2022.10, 2024.

| 2 |

ATTENDING THE VIRTUAL ANNUAL MEETING

Due to the continuing public health impact of the COVID-19 pandemic and to support the health and well-being of our stockholders, coworkers and representatives, the Board of Directors has determined that it is prudent to hold thisThis year’s Annual Meeting is being held in a virtual-only format via live audio webcast. To participate in the Annual Meeting online, please visit www.virtualshareholdermeeting.com/CDW2022CDW2024 and enter the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card or the instructions that accompanied your proxy materials. You will be able to vote your shares electronically during the Annual Meeting by following the instructions available on the meeting website. For beneficial holders who do not have a control number, please contact your broker, bank or other nominee as soon as possible so that you can be provided with a control number and gain access to the meeting. If you do not have access to a 16-digit control number, you may access the meeting as a guest by going to www.virtualshareholdermeeting.com/CDW2022CDW2024, but you will not be able to vote during the meeting or ask questions.

By Order of the Board of Directors,

Frederick J. Kulevich

Senior Vice President, General Counseland

& Corporate Secretary

and Interim Chief People Officer

April 7, 202210, 2024

Important Notice Regarding Availability of Proxy Materials for the Annual Meeting to be Held on May The proxy materials relating to our |

| 3 |

| 4 |

You are entitled to vote at the 20222024 Annual Meeting of Stockholders (the “Annual Meeting”) if you were a stockholder of CDW Corporation (the “Company” or “CDW”) as of the close of business on March 23, 2022,25, 2024, the record date for the Annual Meeting.

Please cast your vote as soon as possible on all of the proposals listed below to ensure that your shares are represented.

| Proposal | Topic | Information | Board Recommendation | |||

| Proposal 1 | Election of Directors | Page 24 | FOR each Director Nominee | |||

| Proposal 2 | Advisory Vote to Approve Named Executive Officer Compensation | Page 37 | FOR | |||

| Proposal 3 | Ratification of Selection of Independent Registered Public Accounting Firm | Page 65 | FOR | |||

| Proposal 4 | Stockholder Proposal Regarding | Political Spending Disclosure | Page | AGAINST |

The Annual Meeting will be held via live audio webcast on Thursday,Tuesday, May 19, 2022,21, 2024, at 7:30 a.m. CDT, in a virtual-only meeting format. There will not be a physical location for the Annual Meeting, and you will not be able to attend the meeting in person.

You are entitled to participate in the Annual Meeting if you were a stockholder as of the close of business on March 23, 2022,25, 2024, the record date. To participate in the Annual Meeting online, please visit www.virtualshareholdermeeting.com/CDW2022CDW2024 and enter the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card or the instructions that accompanied your proxy materials. For beneficial holders who do not have a control number, please contact your broker, bank or other nominee as soon as possible so that you can be provided with a control number and gain access to the meeting. If you do not have access to a 16-digit control number, you may access the meeting as a guest by going to www.virtualshareholdermeeting.com/CDW2022CDW2024, but you will not be able to vote during the meeting or ask questions.

Even if you plan to attend our virtual Annual Meeting via webcast, please read this proxy statement with care and vote right away as described in the Notice on p. 2 of this proxy statement. For stockholders of record, have your notice and proxy card in hand and follow the instructions. If you hold your shares through a broker, bank or other nominee, you will receive voting instructions from your broker, bank or other nominee, including whether telephone or Internet options are available.

| 2024 Proxy Statement | 5 |

You may vote electronically via webcast at the Annual Meeting by following the instructions available on the meeting website.

We provide answers to many frequently asked questions about the meeting and voting under “Frequently Asked Questions Concerning the Annual Meeting” beginning on p. 6071 of this proxy statement.

|

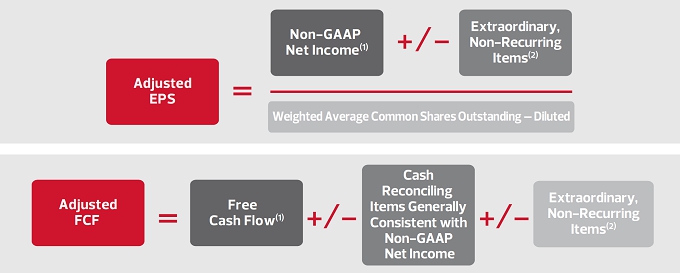

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement and our 20212023 Annual Report on Form 10-K carefully before voting at the Annual Meeting of Stockholders. Measures used in this proxy statement that are not based on accounting principles generally accepted in the United States (“non-GAAP”) are each defined and reconciled to the most directly comparable GAAP measure in Appendix A.ThisA. This proxy statement also contains forward-looking statements; see Appendix B for more information.

We are a leadingmarket-leading multi-brand provider of information technology (“IT”) solutions to over 250,000 small, medium and large business, government, education and healthcare customers in the United States (“US”), the United Kingdom (“UK”) and Canada. We are a Fortune 500 company and member of the S&P 500 Index with approximately 13,90015,100 coworkers. Our broad array of offerings ranges from discrete hardware and software products to integrated IT solutions and services that include on-premise hybrid and cloud capabilities across hybrid infrastructure, digital experience, and security.

We are vendor, technology, and consumption model “agnostic,” withunbiased, offering a solutions portfolio including more than 100,000broad selection of products and services from more than 1,000 leading and emerging brands.multi-branded solutions. Our solutions are delivered in physical, virtual, and cloud-based environments through approximately 9,90010,900 customer-facing coworkers, including sellers, highly-skilled technology specialists and advanced service delivery engineers. We are a leading sales channel partner for many original equipment manufacturers, software publishers and cloud providers (collectively, our “vendor partners”), whose products we sell or include in the solutions we offer. We provide our vendor partners with a cost-effective way to reach customers and deliver a consistent brand experience through our established end-market coverage, technical expertise, and extensive customer access.

We simplify the complexities of technology across design, selection, procurement, integration and management for our customers. Our goal is to have our customers, regardless of their size, view us as a trusted adviser and extension of their IT resources. Our multi-brand offering approach across our vendor partners enables us to identifyprovide the products or combination of products from our vendor partnerssolutions and services that best address each customer’s specific IT requirements.requirements to enable their desired business outcomes.

We have capabilities to provide integrated IT solutions in more than 150 countries for customers with primary locations in the US, UK, and Canada, which are large and growing markets. According to the International Data Corporation, the total US, UK, and Canadian IT market generated approximately $1.2 trillion in sales in 2021.

We believe our addressable markets in the US, UK and Canada represent approximately $400 billion in sales in 2021. These are highly fragmented markets served by thousands of IT resellers and solutions providers. We believe that demand for IT will continue to outpace general economic growth in the markets we serve fueled by new technologies, including hybrid and cloud computing, virtualization, mobility and mobilityartificial intelligence, as well as growing end-user demand for security, efficiency and productivity.

As we have evolved with the IT market, we have built an organization with significant scale, reach and deep intimate knowledge of customer and partner needs. When coupled with our market presence, our broad and deep solutions portfolio, and our large and highly-skilled sales and technical organization, we deliver unique value – for both our customers and our vendor partners.

|

2021

Our 2021 performance demonstrated theThe power of our resilient business model, with balance across ourbalanced portfolio of customer end-markets, and our product andbroad solutions portfolio, and reinforced the strength of our strategy.set delivered strong gross profit results in a challenging market during 2023.

| GAAP | Non-GAAP | |

Net Sales $21.4 billion (10.0)% Gross Profit $4.7 billion (0.7)% | Operating Income $1.7 billion (3.1)% Net income per diluted share $8.10 (0.4)% | Operating Income $2.0 billion (0.6)% Net income per diluted share $9.88 0.9% |

| Percentages are year-over-year. See Appendix A for a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP measure. | ||

There were three main drivers of performance in 2021:2023:

| • | First, our balanced portfolio of our diverse customer end-markets, |

| • | Second, the breadth and depth of our |

| • | Third, we continued to make excellent progress against our three-part strategy for |

| 2024 Proxy Statement | 8 |

We also made progress against our four 20212023 capital allocation priorities. These priorities are designed to provide stockholders with a balance between receiving short-term capital returns and long-term value creationcreation. Our first priority is to increase dividends annually. In November 2023, we increased our dividend by providing us5%, the tenth consecutive year of dividend increases. Our dividend has increased nearly fifteen-fold from its initial level in 2013. We returned more than $820 million in cash to stockholders in 2023 via dividends and share repurchases – within our targeted range we laid out at the beginning of the year. We ended 2023 with a net leverage ratio of 2.4 times, demonstrating strong growth and excellent cash generation and within our targeted range. We also completed the flexibility required to executeacquisitions of both Locus Recruiting and Enquizit, successfully supplementing our long-term growth strategy.organic investments in the business.

|

20212023 CAPITAL ALLOCATION PRIORITIES

| PRIORITIES | OBJECTIVES | ACTIONS | |

| Increase Dividends Annually | Target ~25% payout of | ||

| Maintain NetLeverage Ratio(1) | |||

| Supplement Organic Growth with M&A | Expand CDW’s strategic capabilities | ||

| Return Excess Adjusted Free Cash Flow after Dividends & M&A Through Share Repurchases |

| (1) | Defined as the ratio of total debt at period-end excluding any unamortized discount and/or premium and deferred financing costs, less cash and cash equivalents, to trailing |

| (2) |

For further details about our performance in 2021,2023, please see the Company’s 20212023 Annual Report on Form 10-K.

| 2024 Proxy Statement | 9 |

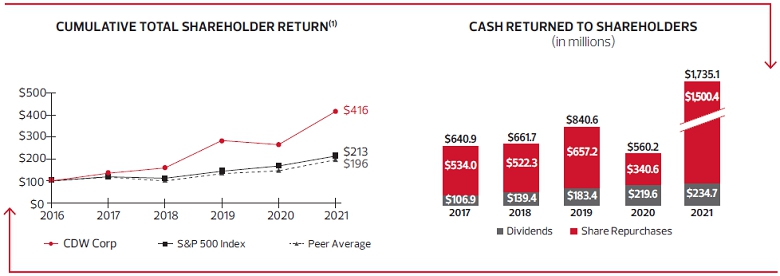

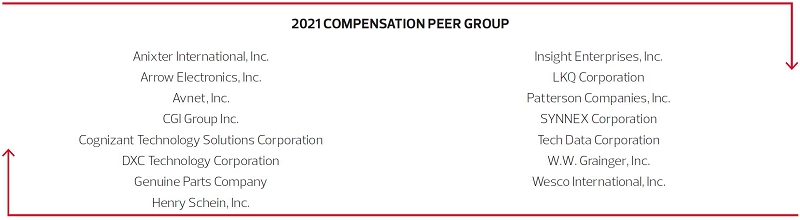

Over the past 5 years, our cumulative total shareholder return has outpaced that of both the S&P 500 Index and our 2021 revised2023 compensation peer group set forth in the “Compensation Discussion and weAnalysis — Comparison to Relevant Peer Group” section of this proxy statement and stayed relatively in line with that of the S&P 500 Information Technology (IT) Index. We have returned $4.4$4.2 billion to shareholders through dividends and share repurchases.repurchases over that time period.

|

The cumulative total shareholder return chart compares the cumulative total shareholder return, including reinvestment of dividends, on $100 invested in CDW common stock for the period from market close on December 31, 2018 through market close on December 31, 2023, with the cumulative total return for the same time period of the same amount invested in the S&P 500 Index, the S&P 500 IT Index and our 2023 compensation peer group set forth in the “Compensation Discussion and Analysis — Comparison to Relevant Peer Group” section of this proxy statement.

|

|

|

| 2024 Proxy Statement | 10 |

Our Board strives to maintain a highly independent, balanced and diverse group of directors that collectively possess the skills and expertise to ensure effective oversight. Over the last five years, the Board has appointed four new directors, all of whom are diverse.

| Name & Professional Background | Age | Director Since(1) | Independent | Committee Memberships | Other Public Company Boards | |

| Virginia C. Addicott Retired President & Chief Executive Officer, FedEx Custom Critical | 60 | 2016 |  | ▪ Audit ▪ Nominating & Corporate Governance | 1 |

| James A. Bell Retired Executive Vice President, Corporate President & Chief Financial Officer, The Boeing Company | 75 | 2015 |  | ▪ Audit (Chair) ▪ Nominating & Corporate Governance | — |

| Lynda M. Clarizio Co-Founder and General Partner of The 98 and Former Executive Vice President, Strategic Initiatives, The Nielsen Company (US), LLC | 63 | 2015 |  | ▪ Compensation ▪ Nominating & Corporate Governance | 3 |

| Anthony R. Foxx Former United States Secretary of Transportation | 52 | 2021 |  | ▪ Compensation ▪ Nominating & Corporate Governance | 2 |

| Kelly J. Grier Retired US Chair and Managing Partner (CEO), Ernst & Young LLP | 54 | 2023 |  | ▪ Audit ▪ Nominating & Corporate Governance | 2 |

| Marc E. Jones Chairman, President and Chief Executive Officer of Aeris Communications, Inc. | 65 | 2023 |  | ▪ Audit ▪ Nominating & Corporate Governance | 1 |

| Christine A. Leahy Chair, President & Chief Executive Officer, CDW Corporation | 59 | 2019 | — | — | 1 |

| Sanjay Mehrotra President & Chief Executive Officer, Micron Technology, Inc. | 65 | 2021 |  | ▪ Compensation (Chair) ▪ Nominating & Corporate Governance | 1 |

| David W. Nelms (Lead Independent Director) Retired Chairman & Chief Executive Officer, Discover Financial Services, Inc. | 63 | 2014 |  | ▪ Nominating & Corporate Governance (Chair) | — |

| Joseph R. Swedish Retired Chairman, President & Chief Executive Officer, Anthem, Inc. | 72 | 2015 |  | ▪ Compensation ▪ Nominating & Corporate Governance | 2 |

| Donna F. Zarcone Retired President & Chief Executive Officer, The Economic Club of Chicago | 66 | 2011 |  | ▪ Audit ▪ Nominating & Corporate Governance | 1 |

|

The chart below provides summary information regarding each of our current directors standing for re-election at the Annual Meeting.

| Name & Professional Background | Age | Director Since(1) | Independent | Committee Memberships | Other Public Company Boards | |

| Virginia C. Addicott Retired President & Chief Executive Officer, FedEx Custom Critical | 58 | 2016 |  | • Audit (Chair)

• Nominating & Corporate Governance | 1 |

| James A. Bell Retired Executive Vice President, Corporate President & Chief Financial Officer, The Boeing Company | 73 | 2015 |  | • Audit

• Nominating & Corporate Governance | 1 |

| Lynda M. Clarizio Former Executive Vice President, Strategic Initiatives, The Nielsen Company (US), LLC | 61 | 2015 |  | • Compensation

• Nominating & Corporate Governance | 3 |

| Paul J. Finnegan Co-Chief Executive Officer, Madison Dearborn Partners, LLC | 69 | 2011 |  | • Compensation

• Nominating & Corporate Governance | — |

| Anthony R. Foxx Former United States Secretary of Transportation | 50 | 2021 |  | • Audit

• Nominating & Corporate Governance | 3 |

| Christine A. Leahy President & Chief Executive Officer, CDW Corporation | 57 | 2019 | – | – | 1 |

| Sanjay Mehrotra President & Chief Executive Officer, Micron Technology, Inc. | 63 | 2021 |  | • Compensation

• Nominating & Corporate Governance | 1 |

| David W. Nelms (Independent Chairman) Retired Chairman & Chief Executive Officer, Discover Financial Services, Inc. | 61 | 2014 |  | • Audit

• Nominating & Corporate Governance (Chair) | — |

| Joseph R. Swedish Retired Chairman, President & Chief Executive Officer, Anthem, Inc. | 70 | 2015 |  | • Compensation (Chair)

• Nominating & Corporate Governance | 3 |

| Donna F. Zarcone Retired President & Chief Executive Officer, The Economic Club of Chicago | 64 | 2011 |  | • Audit

• Nominating & Corporate Governance | 1 |

| (1) | The time period for service as a director of CDW includes service on the Board of Managers of CDW Holdings LLC, our parent company prior to our initial public offering in 2013. |

|

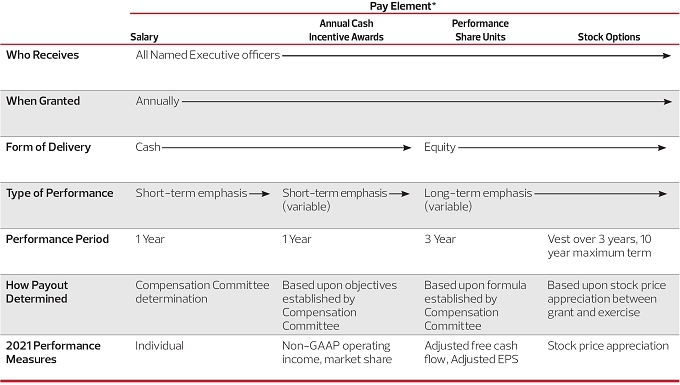

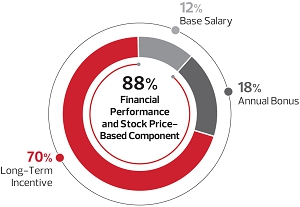

Our executive compensation program is focused on driving sustained meaningful profitable growth and stockholder value creation. The Compensation Committee seeks to foster these objectives through a compensation system that focuses heavily on variable, performance-based incentives that create a balanced focus on our short-term and long-term strategic and financial goals. As shown in the chart, in 2021,2023, approximately 88%91% of the target compensation of our Chair, President and Chief Executive Officer was variable, and is realized only ifwith the applicablevalue tied to the achievement of specified financial performance goals are met and/or our stock price increases.performance.

| 2024 Proxy Statement | 12 |

Our executive compensation practices include the following, each of which the Compensation Committee believes reinforces our executive compensation objectives:

OUR EXECUTIVE COMPENSATION PRACTICES

| What We Do |  | What We Don’t Do | |

| • | Significant percentage of target annual compensation delivered in the form of variable compensation tied to performance | • | We do not have 280G tax gross-ups | |

| Long-term objectives aligned with the creation of stockholder value | • | We do not have an enhanced severance multiple upon a change in control | |

| Target total compensation at the competitive market median | • | We do not have excessive severance benefits | |

| Market comparison of executive compensation against a relevant peer group | • | We do not pay dividends or dividend equivalents on unearned equity awards under our long-term incentive plan | |

| Use of an independent compensation consultant reporting directly to the Compensation Committee and providing no other services to the Company | |||

| ||||

| ||||

| ||||

| ||||

| ||||

|

| ||||

| ||||

| ||||

| ||||

| We do not allow repricing of underwater stock options under our long-term incentive plan without stockholder approval | |||

| Double-trigger vesting for equity awards in the event of a change in control under our long-term incentive plan | • | We do not allow hedging or short sales of our securities, and we |

| • | Clawback provisions | |||

| • | Annual say-on-pay vote | |||

| • | Limited perquisites | |||

| • | Annual equity awards are granted following the release of the Company’s |

Extensive information regarding our executive compensation program in place for 20212023 can be found in the “Compensation Discussion and Analysis” section of this proxy statement.

|

Stockholders continued to show strong support of our executive compensation program, with approval by approximately 95%90% of the votes cast for the Company’s say-on-pay vote at our 20212023 Annual Meeting of Stockholders and, since our initial public offering in 2013 (“IPO”), our stockholders have overwhelmingly supported our executive compensation program, with an average approval of 97%approximately 96% of the votes cast for the Company’s say-on-pay vote at the annual meetings of stockholders since our IPO.

|

Our success is built on the trust we have earned from our customers, coworkers, business partners, investors and communities, and that trust sustains our success. Part of this trust stems from our commitment to good corporate governance. Our Company is governed by our Board of Directors (“Board of Directors” or “Board”). The Board is responsible for providing oversight of the strategic and operational direction of the Company and supporting the Company’s long-term interests.

To provide a framework for effective governance, our Board has adopted Corporate Governance Guidelines, which outline the operating principles of our Board and the composition and working processes of our Board and its committees. The Nominating and Corporate Governance Committee periodically reviews our Corporate Governance Guidelines and developments in corporate governance and recommends proposed changes to the Board for approval.

Our Corporate Governance Guidelines, along with other corporate governance documents such as committee charters and The CDW Way Code (our code of business conduct and ethics), are available on the Governance section of our Investor Relations website at investor.cdw.com. These documents and any other information available on our website are not part of, or incorporated by reference into, this proxy statement.

| |

|  Annual Election of Directors. All directors are elected annually. |

|  Lead Independent Director. David W. Nelms serves as our Lead Independent Director.  Independent Board. Our Board of Directors is comprised entirely of independent directors, other than our Chair, who also serves as President and Chief Executive Officer. The independent members of our Board of Directors regularly meet in executive session. |

|  Independent Board Committees. All members of our Audit, Compensation and Nominating and Corporate Governance Committees are independent directors. |

|  Audit Committee Financial Experts. |

|  Board Term Limit. Our Corporate Governance Guidelines provide that a director will not be renominated at the next annual meeting of stockholders after |

|

Proxy Access. Our Bylaws permit a stockholder, or a group of up to 20 stockholders, owning at least 3% of our outstanding common stock continuously for at least 3 years to nominate and include in our proxy materials director nominees constituting up to 2 individuals or 20% of the Board, whichever is greater, as further detailed in our Bylaws. |

|  Majority Vote. Directors are elected by majority vote of our stockholders in uncontested elections. We have a resignation policy that applies if a director fails to receive a majority of the votes cast. |

|  Restrictions on Other Board Service. Our Corporate Governance Guidelines restrict the number of public company boards on which our directors may serve. A director who is currently an executive officer of a public company may serve on a total of 2 public company boards (including our Board) and a director who is not currently an executive officer of a public company may serve on a total of 4 public company boards (including our Board). |

|  Annual Board and Committee Evaluations. Our |

|  No Supermajority Vote Requirements. |

|  No Stockholder Rights Plan. The Company does not have a stockholder rights plan or poison pill. |

|

At CDW, Our ESG Purpose: To empower our business and stakeholders to do great

|

We are committed to implementation of a proactivestrategic Environmental, Social and Governance (“ESG”) agenda with a focus on topics of highest priority and relevance to CDW and our stakeholders. The Nominating and Corporate Governance Committee of our Board of Directors has oversight responsibility for CDW’s ESG programs and policies.

In April 2022, we published our 2021Our annual ESG reportreports and our second annual disclosures under the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD) frameworks. Our ESG report and other disclosures demonstrate our commitment to ESG and our progress, andframeworks are available onwithin the ESG section of our website at cdw.com/esg. In addition, once our 2023 EEO-1 report is filed, we plan to publish our EEO-1 data on our ESG website.

We focus our ESG efforts on the topics, challenges and opportunities where CDW is able to sustainably add value for our stakeholders and make amazing happen.

| ESG Strategy | During 2023, we reevaluated and refined our ESG strategy, strategic pillars and priority ESG topics. The outcome included aligning our efforts around People, Planet, Partnerships & Portfolio, and Practices. Through a formal materiality assessment process, we updated our priority ESG topics to focus our efforts where we are able to make the greatest impact and sustainably add value for our stakeholders. | ||

| People | We are focused every day on earning a position as a premier destination for talent. Consistent with our purpose and values, we prioritize providing healthy and safe work environments and offer numerous training and leadershipdevelopment opportunities to enable coworkers to achieve their personal and professional best. We actively listen and engage our coworkers to foster inclusion, wellbeing and growth, and our global Social Impact strategy empowers coworkers to support causes that matter most to them through matching gifts and time off to volunteer in their communities. We have made investments in digital transformation of our business that enable coworker success and deliver for our customers. | ||

| Planet | In 2023, we announced our three-part greenhouse gas emissions reduction targets: 1) Reduce absolute scope 1 and scope 2 (operational) GHG emissions 42% by 2030 from a 2022 base year; 2) Engage our supply chain so that suppliers representing 80% of purchased goods and services emissions will have science-based targets by 2028; and 3) Collaborate to reduce impact in our value chain, with CDW committing to reduce total scope 3 GHG emissions from remaining categories 25% by 2030 from a 2022 base year. | ||

| Partnerships &Portfolio | Expanding our portfolio of environmentally certified products and collaborating with our partners and customers on shared ESG priorities were significant milestones for CDW in 2023. We also launched a dedicated Sustainable Solutionssection of our website to enable customers to search for and | order ESG products and solutions and continued to expand our service offerings (including our IT Asset Disposition (ITAD) program) for IT redeployment, remarketingand recycling. We also have continued to increase our | |

| Practices | At CDW, we understand that integrity, trust and good corporate governance matter to all our stakeholders. Recent enhancements to support these principles include: increasing the cadence of ESG-related updates to the Nominating and Corporate Governance Committee of our Board of Directors; updating the CDW Way Code and launching an easier-to-use digital version of the Code for all coworkers; rolling out additional anti-bribery and anti-corruptiontraining, which all coworkers across the globe are required to complete; maintaining a critical set of ISO certifications for quality, environment, services, information security, counterfeit avoidance and supply chain; and reinforcing our | ||

Ultimately, our ESG impact is made possible by continuing to drive our financial performance and shareholder value. Our demonstrated ability in sustaining a successful business is a key contributor to our continued ESG progress.

|

RecognitionsCDW’s ESG Pillars & Priority Topics

Priority topics for measurement and disclosure (based on 2023 materiality assessment)

| 2024 Proxy Statement | |||

|

|

| ||

Under our Corporate Governance Guidelines and the listing standards of the Nasdaq Global Select Market (“Nasdaq”), a majority of our Board members must be independent. The Board of Directors annually determines whether each of our directors is independent. In determining independence, the Board follows the independence criteria set forth in the Nasdaq listing standards and considers all relevant facts and circumstances.

Under the Nasdaq independence criteria, a director cannot be considered independent if he or she has one of the relationships specifically enumerated in the Nasdaq listing standards. In addition, the Board must affirmatively determine that a director does not have a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board has affirmatively determined that each of our current directors, other than our Chair, President and Chief Executive Officer, Christine A. Leahy, and each of the directors who served during the last completed fiscal year is independent under the applicable listing standards of Nasdaq. In making its determination, the Board considered that Ms. Grier served as US Chair and Managing Partner (CEO) of Ernst & Young LLP, the Company’s independent registered public accounting firm, until July 2022 and that Ms. Grier did not personally work on the audit of the Company by Ernst & Young LLP since 2014. Because Ms. Grier is retired from Ernst & Young LLP and due to the significant length of time since she last worked on the Company’s audit, the Board found that her prior relationship with Ernst & Young LLP does not interfere with the exercise of her independent judgment in carrying out her responsibilities as a director of the Company.

Christine A. Leahy | Christine A. Leahy, |

The Board believes that having the Company’s Chief Executive Officer serve as Board Chair is in the best interest of its stockholders at this time because this structure ensures a seamless flow of communication between management and David W. Nelms servesthe Board, in particular with respect to the Board’s oversight of the Company’s strategic direction and risk management, as our non-executive Chairman.well as the Board’s ability to ensure management’s focused execution of that strategy. The Board presentlyadditionally believes that, separatingbecause the roles of Chairman and Chief Executive Officer aids inis the Board’s oversight responsibility. However,director most familiar with the Company’s business, industry and day-to-day operations, she is well-positioned to help the Board does not believe that a single leadership structure is right for all companies at all times, sofocus on those issues of greatest importance to the Company and its stockholders and to assist the Board periodically reviewswith identifying the Company’s strategic priorities, as well as the short-term and long-term risks and challenges facing the Company. While independent directors have invaluable experience and expertise from outside the Company and its leadership structurebusiness, giving them different perspectives regarding the development of the Company’s strategic goals and objectives, the Chief Executive Officer is well-suited to determine, based on the circumstances at such time, what leadership structure would be most appropriate.bring Company-specific experience and industry expertise to her discussions with independent directors.

|

David W. Nelms | The primary roles of our Lead Independent Director are to assist the Chair in managing the governance of the Board and to serve as a liaison between the Chair and other directors. The responsibilities of the Lead Independent Director, which are described in the Company’s Corporate Governance Guidelines, include, among others: |

| RESPONSIBILITY | DESCRIPTION | |

| Board Meetings | Presides at all meetings of the Board at which the Chair is not present, including all executive sessions of the non-management and/or independent directors | |

| Executive Sessions | Has the authority to call meetings of the non-management and/or independent directors | |

| Agendas | Provides input to the Chair on the annual Board calendar, agenda items and schedules for each Board meeting and the materials and information to be presented to the Board | |

| Communicating with Stockholders | Serves as a contact for and may represent the Board in communications with stockholders and other stakeholders who wish to communicate with non-management directors |

Under our Corporate Governance Guidelines, our directors are expected to attend meetings of the Board and applicable committees and our annual meetings of stockholders.

In 2021,2023, the Board held fivefour meetings. In 2021,2023, each of the directors attended at least 75% of the aggregate of all meetings of the Board and the committees on which he or she served (during the periods for which he or she served on the Board and such committees). In addition, each of our directors then serving attended our 20212023 Annual Meeting of Stockholders.

Our Board has an Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Our Board has adopted charters for each of these committees, which are available on the Governance section of our Investor Relations website at investor.cdw.com. Under the committees’ charters, the committees report regularly to the Board and as the Board requests. Additional information on each of these committees is set forth below.

| 2024 Proxy Statement | 18 |

| All Members Independent | Audit Committee

| |||

| Primary Responsibilities: | ||||

James A. Bell Virginia C. Addicott Kelly J. Grier Marc E. Jones Donna F. Zarcone

| Our Audit Committee is responsible for, among other things: (1) appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm; (2) discussing with our independent registered public accounting firm its independence from management; (3) reviewing with our independent registered public accounting firm the scope and results of its audit; (4) preapproving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; (5) overseeing the accounting and financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC; (6) reviewing and monitoring our accounting principles, accounting policies and financial and accounting controls; (7) establishing procedures for the confidential and anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters; (8) reviewing and approving or ratifying related person transactions; (9) overseeing our

Meetings Held in 2023: 10 Independence: Each member of the Audit Committee meets the audit committee independence requirements of Nasdaq and the rules under the Securities Exchange Act of 1934 (the “Exchange Act”). | |||

| The Board has designated each member of the |

|

All Members | Compensation Committee

| |||

| Primary Responsibilities: | ||||

Sanjay Mehrotra (Chair) Lynda M. Clarizio Anthony R. Foxx

| Our Compensation Committee is responsible for, among other things: (1) reviewing and approving the compensation of our | |||

Meetings Held in 2023: 4 Independence: Each member of the Compensation Committee meets the compensation committee independence requirements of Nasdaq and the rules under the Exchange Act. | ||||

| 2024 Proxy Statement | 19 |

All Members | Nominating and Corporate Governance Committee

| |||

| Primary Responsibilities: | ||||

David W. Nelms (Chair) Virginia C. Addicott James A. Bell Lynda M. Clarizio Anthony R. Foxx Kelly J. Grier Marc E. Jones Sanjay Mehrotra Joseph R. Swedish Donna F. Zarcone

| Our Nominating and Corporate Governance Committee is responsible for, among other things: (1) identifying individuals qualified to become members of our Board of Directors, consistent with criteria approved by our Board; (2) evaluating potential nominees for our Board of Directors recommended by our stockholders and maintaining procedures for the submission of stockholder nominees; (3) overseeing the organization and evaluation of our Board to discharge the Board’s duties and responsibilities properly and | |||

Meetings Held in 2023: 4 Independence: Each member of the Nominating and Corporate Governance Committee meets the nominating and corporate governance committee independence requirements of Nasdaq. | ||||

| ||||

One of the primary responsibilities of the Board is to oversee management’s development and execution of the Company’s long-term strategy. Strategy is a recurring topic of discussion at Board meetings, with periodic additional in-depth strategic planning sessions. Discussions on strategy include updates on the ongoing strategic planning process, progress against various strategic initiatives, the competitive landscape and potential risks to the Company’s long-term strategy.

|

Our Board of Directors, as a whole and through the Audit Committee, oversees our Enterprise Risk Management Program (“ERM Program”), which is designed to drive the identification, analysis, discussion and reporting of our high priority enterprise risks. The ERM Program facilitates constructive dialogue at the senior management and Board levels to proactively identify, prioritize and manage enterprise risks.risks that the Company may face over the short-term, intermediate-term, and long-term. Under the ERM Program, senior management develops a holistic portfolio of enterprise risks by facilitating business and supporting function assessments of strategic, operational, financial, reporting and compliance risks on an ongoing basis, and helps to ensure appropriate response strategies are in place. This includes consulting with outside advisors and experts to anticipate future threats and trends affecting the enterprise risk portfolio.

Our Audit Committee is primarily responsible for overseeing our risk management processes on behalf of the full Board. Enterprise risks are considered in business decision making and as part of our overall business strategy. Our management team, including our executive officers, is primarily responsible for managing the risks associated with the operation and business of our company.company, covering all categories and types of risk and including both known and newly identified emerging risks. Senior management provides regular updates to the Audit Committee and periodic updates to the full Board on the ERM Program and reports to both the Audit Committee and the full Board on any identified high priority enterprise risks. This includes risk assessments from management with regard to cybersecurity, including assessments of the overall threat landscape and strategies and infrastructure investments to monitor and mitigate such threats. For more information regarding the Audit Committee’s cybersecurity risk oversight, please refer to “Item 1C. Cybersecurity” of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

In addition, the Board believes that having a Lead Independent Director enhances the Board’s independent oversight of the Company’s risk management provides regular updates toefforts by enabling consultation between the full Board and/or the Audit Committee relating to newly-identifiedChair and evolvingLead Independent Director on high priority risks, such as those presented by the COVID-19 pandemic.enterprise risks.

| 2024 Proxy Statement | 20 |

We are committed to implementation of a proactive ESG agenda with a focus on topics of highest priority and relevance to CDW and our stakeholders. Our Nominating and Corporate Governance Committee has oversight responsibility for CDW’s ESG programs and policies. See the “Environmental, Social and Governance” section of this proxy statement for more information regarding our ESG efforts.

Cultivating a welcoming work environment and inclusive culture that allows all coworkers to feel a sense of belonging, be valued and have the confidence to do great things is fundamental to CDW. We’re a unified team of diverse perspectives, driven by our desire to succeed together. Our Board understands the importance of our inclusive, performance-driven culture to our ongoing success and is actively engaged with our Chair, President and Chief Executive Officer and our Chief Coworker ServicesPeople Officer and Senior Vice President, Coworker Services across a broad range of human capital management topics.

On an annual basis, the Board reviews the results of our annual talent review process and succession plans for our Chair, President and Chief Executive Officer and our other executive officers. In addition, talent strategy is regularly discussed with the Board, including culture, diversity and inclusion, recruiting, retention, engagement and talent development. The Compensation Committee also annually reviews compensation trends and developments and the results of a review of risksrisk analysis of our compensation practices and policies.

We have adopted The CDW Way Code, our code of business conduct and ethics, that is applicable to all of our coworkers and directors. A copy of thisThis code is available on the Governance section of our Investor Relations website at investor.cdw.com. Within The CDW Way Code is a Financial Integrity Code of Ethics that sets forth an even higher standard applicable to our executives, officers, members of our internal disclosure committee and all managers and above in our finance department. We intend to disclose any substantive amendments to, or any waivers from, The CDW Way Code by posting such information on our website or by filing a Form 8-K, in each case to the extent such disclosure is required by rules of the SEC or Nasdaq.

As a company, we do not seek to influence political campaigns or election outcomes through political contributions. We think this practice is best left to individuals acting in their own private capacity and, as such, we encourage all our coworkers, directors and officers to participate in community and political activities on an individual basis, if they so wish, provided they do so in accordance with applicable laws and CDW policies. Those who do participate in community and political activities do so as individual citizens and not as representatives of our Company. Consistent with our values and culture, we have adopted the CDW Political Contributions Policy, which formalizes our long-standing practice not to make contributions or expenditures for purposes of participating or intervening in any campaign on behalf of, or in opposition to, any candidate for public office or influencing the general public with respect to any election or referendum. This policy not to make political contributions or expenditures set forth above extends to contributions to industry groups or trade associations intended for those purposes.

|

Our Policy on Insider Trading, which applies to all coworkers, Board members and consultants, includes policies on hedging, short sales and pledging of our securities. Our policy prohibits hedging or monetization transactions involving Company securities, such as prepaid variable forwards, equity swaps, collars and exchange funds. It also prohibits short sales of our securities, including sales of securities that are owned with delayed delivery. In addition, it prohibits holding Company securities in a margin account or pledging Company securities as collateral for a loan except in limited circumstances with pre-approval from our General Counsel, which pre-approval will only be granted when such person clearly demonstrates the financial capacity to repay the loan without resort to any pledged securities.

See the “Compensation Discussion and Analysis” for a discussion of the Company’s executive compensation policies and practices. We conducted an assessment of the risks associated with our compensation policies and practices, and determined that risks arising from such policies and practices are not reasonably likely to have a material adverse effect on the Company. In conducting the assessment, we undertook a review of our compensation philosophies, our compensation governance structure and the design and oversight of our compensation programs. Overall, we believe that our programs include an appropriate mix of fixed and variable features, and short- and long-term incentives with compensation-based goals aligning with corporate goals. Centralized oversight helps ensure compensation programs align with the Company’s goals and compensation philosophies and, along with other factors, operate to mitigate against the risk that such programs would encourage excessive risk-taking.

Stockholders who would like to communicate with the Board of Directors or its committees or any individual director may do so by writing to them via the Company’s Corporate Secretary by email at board@cdw.com or by mail at our principal executive offices at CDW Corporation, 200 North Milwaukee Avenue, Vernon Hills, Illinois 60061. Correspondence may be addressed to the collective Board of Directors or to any of its individual members or committees at the election of the sender. Any such communication is promptly distributed to the director or directors named therein unless such communication is considered, either presumptively or in the reasonable judgment of the Company’s Corporate Secretary, to be improper for submission to the intended recipient or recipients. Examples of communications that would presumptively be deemed improper for submission include, without limitation, solicitations, communications that raise grievances that are personal to the sender, communications that relate to the pricing of the Company’s products or services, communications that do not relate directly or indirectly to the Company and communications that are frivolous in nature. In addition, when appropriate, the Chairman of the BoardLead Independent Director is available for engagement with stockholders.

During some or all of 2021,2023, our Compensation Committee consisted of Steven W. Alesio, Barry K. Allen, Lynda M. Clarizio, Paul J. Finnegan, Anthony R. Foxx, Sanjay Mehrotra and Joseph R. Swedish. No member of the Compensation Committee was, during 20212023 or previously, an officer or employee of the Company or its subsidiaries. In addition, during 2021,2023, there were no compensation committee interlocks required to be disclosed.

|

The Company has written procedures regarding the approval and ratification of related person transactions. Under these procedures, our Audit Committee is responsible for reviewing and approving or ratifying all related person transactions. If the Audit Committee determines that approval or ratification of a related person transaction should be considered by the Board, such transaction will be submitted for consideration by all disinterested members of the Board. The Chair of the Audit Committee has the authority to approve or ratify any related person transaction in which the aggregate amount involved is expected to be less than $300,000 and in which the Chair of the Audit Committee has no direct or indirect interest.

For these purposes, a related person transaction is considered to be any transaction that is required to be disclosed pursuant to Item 404 of the SEC’s Regulation S-K, including transactions between us and our directors, director nominees or executive officers, 5% record or beneficial owners of our common stock or immediate family members of any such persons, when such related person has a direct or indirect material interest in such transaction.

Potential related person transactions are identified based on information submitted by our officers and managers and then submitted to our Audit Committee for review. The CDW Way Code, our code of business conduct and ethics, requires that our directors and coworkers identify and disclose any material transaction or relationship that could reasonably be expected to create a conflict of interest and interfere with their impartiality or loyalty to the Company. Further, at least annually, each director and executive officer is required to complete a detailed questionnaire that asks questions about any business relationship that may give rise to a conflict of interest and all transactions in which we are involved and in which the executive officer, a director or a related person has a direct or indirect material interest.

When deciding to approve or ratify a related person transaction, our Audit Committee takes into account all relevant considerations, including without limitation the following:

| • | the size of the transaction and the amount payable to or by the related person; |

| • | the nature of the interest of the related person in the transaction; |

| • | whether the transaction may involve a conflict of interest; |

| • | whether the transaction is at arm’s-length, in the ordinary course or on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances; and |

| • | the purpose of the transaction and any potential benefits to us. |

The son of Elizabeth H. Connelly, our Chief Human Resources Officer and Senior Vice President, Coworker Services, is an Account Manager (sales coworker) at the Company. In 2021, Mr. Connelly had total compensation, including salary, commissions, bonuses and sales incentives, of approximately $260,000 and was eligible to participate in Company benefit plans available to similarly situated coworkers. There have been no other transactions since January 1, 20212023 for which disclosure under Item 404(a) of Regulation S-K is required.

|

PROPOSAL 1

Under our Certificate of Incorporation, the number of Board members is set from time to time by the Board. Our Board presently consists of teneleven directors. The terms of all of our directors expire on the date of the 20222024 Annual Meeting, subject to the election and qualification of their successors.

The Board of Directors is responsible for nominating individuals for election to the Board and for filling vacancies on the Board that may occur between annual meetings of stockholders. The Nominating and Corporate Governance Committee is responsible for identifying and screening potential candidates and recommending qualified candidates to the Board for nomination. Third-party search firms may be and have been retained to identify individuals that meet the criteria of the Nominating and Corporate Governance Committee. Kelly J. Grier was identified by our Chief Executive Officer as a possible director candidate and vetted through the Company’s customary review process using a third-party search firm. After completion of this review, Ms. Grier was recommended to the Nominating and Corporate Governance Committee by both our Lead Independent Director and such third-party search firm.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders in the same manner in which it evaluates candidates it identified, if such recommendations are properly submitted to the Company. Stockholders wishing to recommend nominees for election to the Board should submit their recommendations in writing to our Corporate Secretary by email at board@cdw.com or by mail at CDW Corporation, 200 North Milwaukee Avenue, Vernon Hills, Illinois 60061. Nominations for the 20232025 Annual Meeting of Stockholders must be received no earlier than January 19, 202321, 2025 and no later than February 18, 2023.20, 2025. See “Stockholder Proposals for the 20232025 Annual Meeting” for additional information regarding the process for submitting nominations.

Our Bylaws also permit qualified stockholders, or groups of up to 20 stockholders, to nominate and include in our proxy materials director nominees, provided that the stockholder(s) and nominee(s) satisfy the requirements specified in our Bylaws. Notice of a proxy access nomination must be received no earlier than November 8, 202211, 2024 and no later than December 8, 2022.11, 2024. See “Stockholder Proposals for the 20232025 Annual Meeting” for additional information regarding including director nominees in our proxy materials.

Our Board is committed to regular refreshment and strives to maintain a highly independent, balanced and diverse group of directors that collectively possess the expertise to ensure effective oversight. In selecting director candidates, the Nominating and Corporate Governance Committee and the Board of Directors consider the qualifications, attributes, skills, and skillsexperience of the candidates individually and the composition of the Board as a whole. Under our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee and the Board review the following for each candidate, among other qualifications deemed appropriate, when considering the suitability of candidates for nomination as director:

| • | Principal employment, occupation or association involving an active leadership role |

| • | Qualifications, attributes, skills and/or experience relevant to the Company’s business |

| • | Ability to bring diversity to the Board, including gender, race/ethnicity and complementary skills and viewpoints |

| • | Other time commitments, including the number of other boards on which the potential candidate may serve |

| • | Independence and absence of conflicts of interest as determined by the Board’s standards and policies, the listing standards of Nasdaq and other applicable laws, regulations and rules |

| • | Financial literacy and expertise |

| • | Personal qualities, including strength of character, maturity of thought process and judgment, values and ability to work collegially |

|

Our

In considering each director nominee for the Annual Meeting, the Board strivesand the Nominating and Corporate Governance Committee evaluated such person’s qualifications, attributes, skills and experience to maintainserve as a highly independent, balanced and diverse group of directors that collectively possess the expertise to ensure effective oversight.director.

BOARD DIVERSITY HIGHLIGHTSWe believe our Board has a well-rounded variety of qualifications, attributes, skills and experience, and represents a mix of deep knowledge of the Company and fresh perspectives. The table below summarizes some of the qualifications, attributes, skills and experience of each director. This summary is not intended to be an exhaustive list of each director’s skills or contributions to the Board. Further information on each director nominee for this Annual Meeting is set forth in the biographies under “Proposal 1 – Election of Directors — 2024 Nominees for Election to the Board of Directors” in this proxy statement.

| Skills | Racial/Ethnic and Gender Diversity | |||||||||||||||||

| Senior Leadership | Public Company Board Service | Global | Technology Innovation | Finance, Accounting and Risk Management | People and Culture | Government and Regulatory | Race/ Ethnicity | Gender | ||||||||||

|  |  |  |  |  |  |  | |||||||||||

| Addicott |  |  |  |  |  |  | White | F | ||||||||||

| Bell |  |  |  |  |  |  | Black | M | ||||||||||

| Clarizio |  |  |  |  |  |  | White | F | ||||||||||

| Foxx |  |  |  |  |  |  | Black | M | ||||||||||

| Grier |  |  |  |  |  |  |  | White | F | |||||||||

| Jones |  |  |  |  |  |  |  | Black | M | |||||||||

| Leahy |  |  |  |  |  |  |  | White | F | |||||||||

| Mehrotra |  |  |  |  |  |  |  | Asian | M | |||||||||

| Nelms |  |  |  |  |  |  |  | White | M | |||||||||

| Swedish |  |  |  |  |  |  | White | M | ||||||||||

| Zarcone |  |  |  |  |  |  | White | F | ||||||||||

| Total | 11 | 11 | 9 | 10 | 11 | 11 | 8 | 5F/6M | ||||||||||

| BOARD DIVERSITY MATRIX | ||||

| (As of APRIL 7, 2022) | ||||

| Total number of directors: 10 | ||||

| Male | Female | Non-Binary | Gender Undisclosed | |

| Number of directors based on gender identity: | 6 | 4 | — | — |

| Number of directors who identify in any of the categories below: | ||||

| African American or Black | 2 | — | — | — |

| Alaskan Native or Native American | — | — | — | — |

| Asian | 1 | — | — | — |

| Hispanic or Latinx | — | — | — | — |

| Native Hawaiian or Pacific Islander | — | — | — | — |

| White | 3 | 4 | — | — |

| LGBTQ+ | — | — | — | — |

| Did not disclose demographic background | — | — | — | — |

| SKILL | DESCRIPTION | |

| Experience as a senior leader in a complex organization | ||

| Experience with finance, accounting, debt or capital markets, M&A, strategic investments or enterprise risk management including cybersecurity | ||

| People and | Experience managing a large and/or global workforce and building a high performance culture | |

| Government and Regulatory | Government service or extensive interactions with the government and government agencies |

|

The balance of age, tenure, race and gender on our Board reflects the importance that the Board has placed on the diversity of its members. Over the last five years, the Board has appointed four new directors, all of whom are diverse.

BOARD DIVERSITY MATRIX

(As of April 10, 2024)

| Total number of directors: 11 | |||||

| Male | Female | Non-Binary | Gender Undisclosed | ||

| Number of directors based on gender identity: | 6 | 5 | — | — | |

| Number of directors who identify in any of the categories below: | |||||

| African American or Black | 3 | — | — | — | |

| Alaskan Native or Native American | — | — | — | — | |

| Asian | 1 | — | — | — | |

| Hispanic or Latinx | — | — | — | — | |

| Native Hawaiian or Pacific Islander | — | — | — | — | |

| White | 2 | 5 | — | — | |

| LGBTQ+ | 1 | ||||

| Did not disclose demographic background | — | ||||

| 2024 Proxy Statement | 26 |

Each of the teneleven director nominees listed below is currently a director of the Company. Each of the director nominees, other than Christine A. Leahy, our Chair, President and Chief Executive Officer, has been determined by the Board to be independent.

The following biographies describe the business experience of each director nominee. Following the biographical information for each director nominee, we have listed the specific experiencequalifications, attributes, skills, and qualificationsexperience of that nominee that strengthen the Board’s collective qualifications, skills and experience.operation of the Board as a whole. The time period for each of Mr. Finnegan and Ms. Zarcone’s service as a director of CDW includes service on the Board of Managers of CDW Holdings LLC, our parent company prior to our IPO.

If elected, each of the director nominees is expected to serve for a term expiring at the 20232025 Annual Meeting of Stockholders, subject to the election and qualification of his or her successor. The Board expects that each of the nominees will be available for election as a director. However, if by reason of an unexpected occurrence one or more of the nominees is not available for election, the persons named in the form of proxy have advised that they will vote for such substitute nominees as the Board may nominate.

| PROPOSAL 1: THE BOARD OF DIRECTORS RECOMMENDS A VOTE FORTHE FOLLOWING NOMINEES FOR ELECTION AS DIRECTORS. |

| VIRGINIA C. ADDICOTT | Audit | |||

INDEPENDENT Director Age

| Ms. Addicott is the retired President and Chief Executive Officer of FedEx Custom Critical, a North American expedited freight carrier, a position she held from June 2007 to December 2019. Ms. Addicott joined FedEx Custom Critical in 1999 as Division Managing Director, Service and Safety, and in 2001 became Division Vice President, Operations and Customer Service. Prior to joining FedEx Custom Critical, Ms. Addicott spent thirteen years at Roberts Express, Inc. (acquired by FedEx Custom Critical in 1999) in various operations roles. | |||

Other Public Company Directorships: • Element Fleet Management Corp. | Selected Directorships and Positions: •

• Board of Directors, Student Transportation of America • Chair, Board of Directors, Akron Children’s Hospital • Board of Directors, Kent State University Foundation | |||

• • • Global |

• • • People and Culture | |||

| JAMES A. BELL | Audit (Chair) and Nominating and Corporate Governance Committees | |||

INDEPENDENT

Director Age

| Mr. Bell is the retired Executive Vice President, Corporate President and Chief Financial Officer of The Boeing Company, an aerospace company and manufacturer of commercial jetliners and military aircraft. Mr. Bell served in that role at Boeing from 2008 to 2012. Previously, he served as Boeing’s Executive Vice President, Finance and Chief Financial Officer from 2003 to 2008; Senior Vice President of Finance and Corporate Controller from 2000 to 2003; and Vice President of Contracts and Pricing for Boeing Space and Communications from 1996 to 2000. | |||

Other Public Company Directorships: • | Former Public Company Directorships • Apple, Inc. • Dow Inc. •

| |||

• • • Global | • • • Government and Regulatory | |||

|

| LYNDA M. CLARIZIO | Compensation and Nominating and Corporate Governance Committees | |||

INDEPENDENT Director Age 63 | Ms. Clarizio is a strategic advisor to several businesses with a focus on leveraging digital technology and data to drive growth. She also is | |||

Other Public Company Directorships: • Emerald Holding, Inc. • Intertek Group plc • Taboola.com Ltd. | Selected Directorships and Positions: • Board of Directors, Simpli.fi Holdings, Inc. •

• • Leadership Council, Princeton University School of Engineering and Applied Science | |||

• • • Global |

• • Finance, Accounting & Risk Management • People and

| |||

| Compensation and Nominating and Corporate Governance Committees |

INDEPENDENT Director

| ||||

|

| |||

|

| |||

Age | Mr. Foxx was the seventeenth United States Secretary of Transportation from July 2013 to January 2017. Mr. Foxx also served as Chief Policy Officer and Senior Advisor to the President and Chief Executive Officer of Lyft, Inc., a transportation network in the U.S. and Canada, from October 2018 to January 2022 and | |||

Other Public Company Directorships: • Martin Marietta Materials, Inc. • NXP Semiconductors N.V. Former Public Company Directorships • Shelter Acquisition Corporation I | Selected Directorships and Positions: • Advisory Board, AutoTech Ventures • Director, The Volcker Alliance • Senior Fellow, Harvard University Kennedy School’s Belfer Center for Science & International Affairs • Executive in Residence, Carnegie Mellon University | |||

• • • Technology Innovation |

• • • Government and Regulatory | |||

|

| KELLY J. GRIER | Audit and Nominating and Corporate Governance Committees | |||

INDEPENDENT Director Age 54 | Ms. Grier is the retired U.S. Chair and Managing Partner (CEO) of Ernst & Young LLP (EY), a global professional services firm, a position she held from 2018 to 2022. From 2015 to 2018, Ms. Grier was Vice Chair and Central Region Managing Partner, in 2014, was Americas Vice Chair of Talent and prior to that, served in various roles of increasing responsibility in the U.S. and globally during over 30 years of service to EY. Ms. Grier is a certified public accountant. | |||

Other Public Company Directorships: • Illinois Tool Works Inc. • Booking Holdings Inc.

| Selected Directorships and Positions: • Senior Advisor, Permira • Board of Directors, Zendesk, Inc. • Board of Directors, Global Forest Generation • Board of Directors, Peterson Institute for International Economics • Board of Directors, Chief Executives for Corporate Purpose • Board of Directors, CEO Action for Racial Equality | |||

Key Skills and Qualifications: • Senior Leadership • Public Company Board Service • Global • Technology Innovation | • Finance, Accounting & Risk Management • People and Culture • Government and Regulatory | |||

| MARC E. JONES | Audit and Nominating and Corporate Governance Committees | |||

INDEPENDENT Director Age 65 | Mr. Jones serves as the Chairman, President and Chief Executive Officer of Aeris Communications, Inc., a provider of machine to machine and Internet of Things communications services. Mr. Jones has served as Chairman of Aeris since 2005 and President and Chief Executive Officer of Aeris since 2008. He also served as Chairman of Visionael Corporation, a network service business software and service provider, from 2004 to 2009 and as President and Chief Executive Officer of Visionael from 1998 to 2004. Prior to joining Visionael, Mr. Jones served as President and Chief Operating Officer of Madge Networks, a supplier of networking hardware, from 1993 to 1997; Senior Vice President, Integrated System Products at Chips and Technologies, Inc., one of the first fabless semiconductor companies, from 1988 to 1992; and Senior Vice President, Corporate Finance at LF Rothschild Unterberg Towbin & Co., a merchant and investment banking firm, from 1986 to 1987. | |||

Other Public Company Directorships: • Ingersoll Rand Inc. | Selected Directorships and Positions: • Chair, Board of Directors, Aeris Communications, Inc. • Board of Trustees, Stanford University • Chair, Board of Directors, Stanford Health Care • Board of Directors, Lucile Packard Children’s Hospital Stanford • Board of Directors, Management Leadership for Tomorrow | |||

Key Skills and Qualifications: • Senior Leadership • Public Company Board Service • Global • Technology Innovation | • Finance, Accounting & Risk Management • People and Culture • Government and Regulatory | |||

| 2024 Proxy Statement | 29 |

| CHRISTINE A. LEAHY | ||||

CHAIR Director Age

| Ms. Leahy is our Chair, President and Chief Executive | |||

Other Public Company Directorships: • Target Corporation | Selected Directorships and Positions: • Board of Trustees, Brightpoint (formerly Children’s Home & • Board of Directors, Northwestern Memorial Hospital • Board of Directors, Junior Achievement of Chicago • Board of Directors, The Economic Club of Chicago • Board of Directors, Corporate Leadership Center | |||

• • • Global • Technology Innovation |

• • • Government and Regulatory | |||

| SANJAY MEHROTRA | Compensation (Chair) and Nominating and Corporate Governance Committees | |||

INDEPENDENT Director Age 65 | Mr. Mehrotra is the President and Chief Executive Officer of Micron Technology, Inc., a producer of memory and storage solutions, a position he has held since May 2017. Prior to joining Micron, Mr. Mehrotra was the President and Chief Executive Officer of SanDisk Corporation, a provider of flash storage solutions, from January 2011 until its May 2016 sale to Western Digital Corp. Mr. Mehrotra | |||

Other Public Company Directorships: • Micron Technology, Inc.

| Selected Directorships and Positions: •

| |||

• • • Global • Technology Innovation |

• • • Government and Regulatory | |||

| 2024 Proxy Statement | 30 |

| DAVID W. NELMS | ||||

Director Age

| Mr. Nelms currently serves as the | |||

Other Public Company Directorships: • None

| Selected Directorships and Positions: • Executive Board, University of Florida Foundation • Board of Directors, Conserving Carolina • Board of Directors, JDRF T1D Fund | |||

• • • Global • Technology Innovation |

• • • Government and Regulatory | |||

|

| JOSEPH R. SWEDISH | Compensation | |||

INDEPENDENT Director Age

| Mr. Swedish is the retired Chairman, President and Chief Executive Officer of Anthem, Inc., a health benefits | |||

Other Public Company Directorships: • IBM Corporation (through April 2024) • Chair, Mesoblast Limited

Former Public Company Directorships • | Selected Directorships and Positions: • Board of Directors, Centrexion Therapeutics Corporation • Board of Directors, Integrity Implants, Inc. dba Accelus • Board of Directors, Navitus Health Solutions • Board of Visitors, Duke University’s Fuqua School of Business • Board of Trustees, The Nature Conservancy in Colorado | |||

• • • Technology Innovation |

• • • Government and Regulatory | |||

| 2024 Proxy Statement | 31 |

| DONNA F. ZARCONE | Audit and Nominating and Corporate Governance Committees | |||

INDEPENDENT Director Age 66 | Ms. Zarcone is the retired President and Chief Executive Officer of The Economic Club of Chicago, a civic and business leadership organization, a position she held from February 2012 to July 2020. Ms. Zarcone served as Interim President of The Economic Club of Chicago from October 2011 to February 2012. From January 2007 to February 2012, she served as the President and Chief Executive Officer of D.F. Zarcone & Associates LLC, a strategy advisory firm that she founded. Prior to founding D.F. Zarcone & Associates, Ms. Zarcone was President and Chief Operating Officer of Harley-Davidson Financial Services, Inc., a provider of wholesale and retail financing, credit card and insurance services for dealers and customers of Harley-Davidson. After joining Harley-Davidson Financial Services, Inc. in 1994 as Vice President and Chief Financial Officer, Ms. Zarcone was named President and Chief Operating Officer in 1998 and served in that role until 2006. Prior to joining Harley-Davidson Financial Services, Inc., Ms. Zarcone served as Executive Vice President, Chief Financial Officer and Treasurer of Chrysler Systems Leasing, Inc. from 1982 to 1994 and in various management roles at KPMG/Peat Marwick from 1979 to 1982. Ms. Zarcone is a certified public accountant and holds a Certificate in Cybersecurity Oversight from Carnegie Mellon University. | |||

Other Public Company Directorships: • Cigna Corporation | Selected Directorships and Positions: • Board of • Board of Directors, Quinnox Inc. • Advisory Board, • Vice-Chair Elect, National Board, • Directorship Certification, National Association of Corporate Directors | |||

• • • Global |

• • • People and Culture | |||

|

In 2021, each non-employee director received annual compensation in the formThe elements of a $102,500 cash retainer and a $152,500 restricted stock unit award, as well as additional retainers for committee chairs and an additional restricted stock unit award of $150,000 for our Chairman, which remained the same as compared to the 2020 non-employee2023 director compensation program. Our Chairman also serves as Chair of the Nominating and Corporate Governance Committee, but did not receive an additional Chair retainerprogram for that service in 2021.non-employee directors are set forth below. Christine A. Leahy, our Chair, President and Chief Executive Officer in 2023, did not receive any additional compensation for serving as a director in 2021.director. Please see the “2023 Summary Compensation Table” for the compensation received by Ms. Leahy with respect to 2023.

All cash retainers are paid quarterly in arrears and, if applicable, are prorated based upon Board or chair service during the calendar year. Board members may defer cash retainers under the CDW Director Deferred Compensation Plan. Amounts credited to the CDW Director Deferred Compensation Plan will be notionally invested, as elected by the director, in the same investment options as available under the Company’s coworker 401(k) plan.

The annual Board and ChairmanLead Independent Director restricted stock unit grants vest on the first anniversary of the grant date and entitle the director to receive shares of our common stock upon vesting, subject to deferral in five-year increments. In the year of appointment to the Board, a director receives a prorated portion of the annual restricted stock unit grant value based upon the number of months between appointment and the vesting date of the most recent annual grant to incumbent directors, which prorated award vests on the same vesting date as the most recent annual grant to incumbent directors. The annual Board restricted stock unit grant vests on a prorated basis if a director does not stand for re-election or is not re-nominated for election at an annual meeting during the vesting period. The annual ChairmanLead Independent Director restricted stock unit grant vests on a prorated basis if service as ChairmanLead Independent Director terminates.